Introduction

Expanding into Spain or Portugal is a strategic opportunity for many European companies. Rather than immediately hiring full-time staff, an increasingly popular and effective alternative is to collaborate with a sales partner: a self-employed agent or freelancer who handles business development and sales on a performance-driven basis.

In this article — a pillar content piece — we examine recent evidence (2023–2025) that demonstrates why the sales partner model is growing in Iberia, explore the advantages and risks, and outline practical steps to select and manage the right partner. If you prefer to skip ahead, jump to practical selection advice.

Key Trends Supporting the Growth of Self-Employment & Agents

Growth of Autónomos / Freelancers in Spain

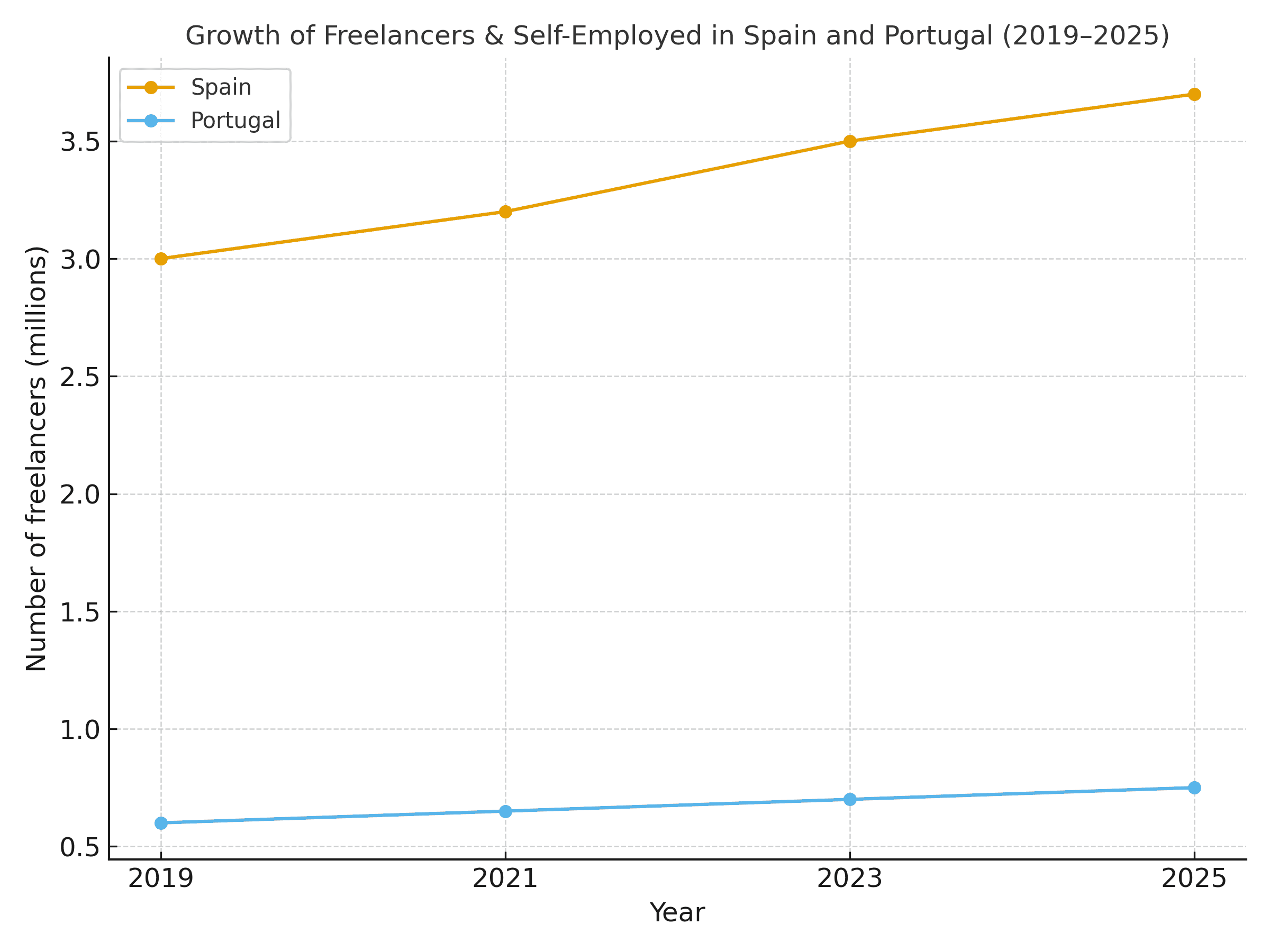

Spain’s self-employed population (commonly called autónomos) has been growing, with national registries showing more than 3.4 million self-employed workers in 2025. This expansion creates a large pool of independent professionals who can act as effective sales partners for foreign firms entering the market.

Sources such as national registries and statistical aggregators show a sustained increase in self-employment across the last years, particularly in service and knowledge sectors.

Foreign Freelancers as Major Drivers

Much of the recent growth in Spain’s self-employed population has come from foreign nationals. In 2025, a substantial share of new autónomos were foreign residents, many drawn to flexible, independent activity in professional and technical fields. These foreign self-employed professionals often bring multi-lingual skills, international contacts and regional mobility — attributes valuable for a cross-border sales partner.

Self-employed Figures in Portugal

Portugal also shows a strong base of self-employed professionals (hundreds of thousands under domestic concepts). Rates of self-employment in Portugal are near the EU average, and the pool of freelancers and independent consultants supports the availability of high-quality sales partners for international companies.

For broader context, look at labor statistics and Eurostat data to compare the share of self-employment across the region.

Sectors Most Affected: Services, Communications, and Sales

Growth has concentrated in services, information & communications, professional & technical activities, and commerce — sectors where sales outreach, representation and networks are essential. These sectors map directly to the traditional strengths of independent agents and sales partners.

Economic, Regulatory & Labor Market Pressures

Rising fixed costs and administrative burdens can push businesses and professionals to prefer flexible arrangements. At the same time, regulators and courts across Europe have paid closer attention to classification issues for gig work and self-employment, increasing the need for well-structured, compliant contracts when using independent sales partners.

An important resource on regulatory developments is the European Parliament’s publications regarding platform work and workers’ rights.

Why These Trends Make the Sales Partner Model More Attractive

Cost, Risk & Flexibility

Compared with hiring full-time employees (salary, social security, severance and other fixed costs), engaging a sales partner means a variable cost model where payment is linked to results. This reduces upfront investment and financial risk while enabling companies to test market fit.

Local Expertise & Speed to Market

Local agents already have networks and cultural knowledge, which accelerates relationship building and shortens the time-to-market for your product or service.

Performance Incentives & Scalability

Commission or mixed commission models align incentives: the sales partner is motivated to close deals and grow revenues. Also, you can scale by adding partners in new regions without having to hire and manage a larger payroll.

Regulatory Simplification

While not risk-free, B2B relationships with independent professionals typically avoid certain employment obligations. This simplifies HR administration, though contracts must still be carefully drafted to avoid misclassification.

Challenges & What to Watch Out For

Misclassification Risk & Legal Obligations

If a partner works under conditions that resemble employment (fixed hours, exclusivity, direct control), local law may reclassify them as an employee — exposing the company to retroactive liabilities. Carefully drafted contracts and operational practices (non-exclusive arrangements, outcome-based KPIs) help mitigate that risk.

Expenses, Taxes & Social Security

Self-employed partners bear their own taxes and social contributions. Commission levels must be attractive enough to compensate for these costs and for the partner’s overhead.

Ensuring Alignment & Quality

Not every partner will deliver consistent results. Define clear KPIs, reporting routines, and training to ensure alignment with your brand and sales process.

Integration & Oversight

Even independent partners benefit from onboarding: product training, marketing materials and an agreed sales process. Invest in these to increase conversion rates and customer satisfaction.

Case Examples & Statistical Illustrations

The recent growth in Spain’s self-employed registries — particularly among foreign nationals — and strong freelancer pools in Portugal illustrate the growing availability of experienced, independent professionals who can serve as effective sales partners.

For a deeper dive into EU regulatory context, see the European Parliament’s coverage on platform work. For country statistical breakdowns, national registries and Eurostat offer up-to-date figures on self-employment rates and sectoral distribution.

External references:

How to Select a Great Sales Partner in Spain & Portugal

Criteria to Use

- Local market knowledge: regional experience and language skills.

- Network of contacts: distributors, buyers, channel partners.

- Complementary skills: negotiation, after-sales care and follow-through.

- Reputation & references: check past performance and client feedback.

Contract Terms & Commission Models

Specify commission structure (percentage, tiered rates, bonuses), territory, any exclusivity terms, minimum performance thresholds, and clear termination clauses. Avoid clauses that imply employee-style control (fixed schedule, mandatory daily reporting).

Measuring Performance & Feedback Loops

Track measurable KPIs such as leads generated, conversion rate, deal size and time to close. Hold recurring reviews and provide ongoing product training and marketing collateral to help partners succeed.

Conclusion & Next Steps

The data and market observations up to 2025 show that flexible, performance-driven collaboration with self-employed professionals is a growing and practical way to expand in Spain and Portugal. For many European companies, working with a sales partner offers lower fixed costs, faster market entry, local know-how, and aligned incentives.

If you are planning expansion into Iberia and want a reliable, compliant, and effective approach, consider Fiderenos as your strategic partner. We help European companies identify, contract and manage high-quality sales partners in Spain and Portugal so you can scale confidently and efficiently.

Contact Fiderenos to discuss how a sales partner model can accelerate your growth in Iberia.